Welcome to Nova Partners

Guiding businesses through the transactions that define them.

A specialist advisory firm working with businesses and private equity investors on debt financing, mergers and acquisitions, and strategic transactions across mature markets.

Our Approach

Collaborative, Long-term partnerships

Sustained outcomes are achieved through genuine collaboration. We focus on building enduring client relationships founded on openness, integrity, and mutual trust. The length and continuity of many of our partnerships, several extending back to our firm’s earliest days, reflect both our relationship-led approach and the consistency of our results.

Our Principles

From Trusted advice to optimal outcomes

Disciplined, Structured Execution

Our approach is highly process-led, combining rigorous preparation, structured lender engagement, and controlled execution to deliver clarity, efficiency, and consistent results throughout the transaction lifecycle.

Proven Through Market Cycles

We have advised on transactions across both challenging and favourable market conditions. This depth of experience provides valuable perspective, enabling clients to move forward with confidence and avoid common missteps in complex or uncertain environments.

Fundraise with ease

Work with Nova Partners raising experts to execute the strategy & operations of your round.

Get Organized

Transform the fundraising process into a strategic advantage

Save Time

Delegate time-consuming tasks to people you can trust

See Results

Stay on track during the highs and lows of your fundraising round

Our Services

Our focus: delivering strategic debt solutions

Strategic Advisory

Restructuring & Special Situations

Are you running a high-growth startup?

We work with founders building category-defining companies solving meaningful problems. If you have real traction, let’s talk.

The Nova Partners Department Fundraising Experts

Awais Tauqir

CEO

Awais holds a degree in Economics and is an investment banking professional with experience advising corporates and financial sponsors on M&A and capital raising transactions at J.P. Morgan. He has executed buy-side and sell-side M&A, as well as debt and equity financings, with responsibility across transaction structuring, valuation, due diligence, and end-to-end execution. Prior to investment banking, he advised senior executives on corporate strategy at PwC. Awais brings an institutional, execution-driven approach to strategic transactions and capital solutions.

Awais Tauqir

CEO

- Phone:+1 (859) 254-6589

- Email:info@example.com

TBC

TBC

TBC

TBC

TBC

TBC

Nova Partners raised for a few of our favourite clients

UpCounsel

“Not only did you help me identify the right investors and how to get the strongest introductions to them, you also helped me build signal and develop an end-to-end process around the raise. I literally couldn’t have done it without you. You had my back the entire step of the way and created space to openly discuss the inevitable highs and lows of the raise process.”

KJ Erickson, CEO

AKT London

“It’s actually amazing what you’ve created for us. Who knew a spreadsheet could deliver so much joy!”

Edward Currie, Founder

RASA

“I felt your execution was excellent, I will highly recommend Capital Department, and we hope to work with you on future raises.”

Stephan Van Der Mersch, CFO

Koia

“The process, support, and professionalism you provided exceeded all expectations. You provided urgency without panic, you pushed without being pushy, and provided thorough communication without over-communicating. A rare skill set that helped get the job done, and was appreciated by the whole team!”

Chris Pruneda, CMO

Atom Limbs

“A+… thanks for crushing this!”

Tyler Hayes, CEO & Co-founder

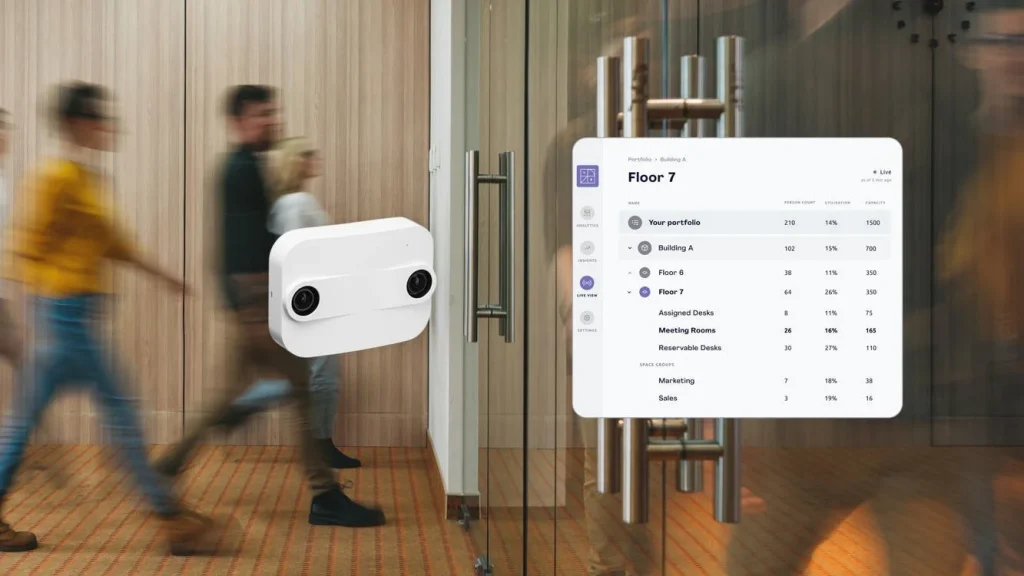

VergeSense

“You were a key part of our success across three venture rounds. You have fantastic attention to detail and had my full trust in creating fundraising pipelines, organizing data rooms, and responding to investor requests.“

Dan Ryan, CEO & Co-founder

End-to-end fundraising support for founders and CEO's

Let’s raise!

We work with a limited number of businesses.

If you think you’re a fit, we’d love to hear from you.